Comprehensive Hearing Aid Insurance: Protect your Hearing Health with Hear4U and Assetsure!

Your Hearing Aids New Specialist Insurance!

Hearing aids keep you connected, but their small size makes them prone to loss, damage, or theft. Replacements can be costly, but with Hear4U & Assetsure New Hearing Aid Insurance, you get complete protection and peace of mind.

- All-Risk Protection

- Affordable Premiums

- Hassle-Free Claims

How to Get Started

Quote

Click the link below to get an instant

quote.

Choose

Choose the coverage that fits your

needs.

Secure

Complete your application and enjoy immediate hearing aids protection.

Protect your Hearing Health with Hear4U + Assetsure!

Ensure your hearing aids are fully protected with the most comprehensive insurance available. Don’t wait, safeguard your hearing health with expert-backed coverage today!

Why Choose Hearing Aid Insurance?

All-Risk Protection

Covers loss, reported theft, accidental damage, and even unexplained disappearance.

Worldwide Coverage

Travel with confidence knowing your hearing aids are insured globally for up to 60 consecutive days each trip.

Fast & Hassle-Free Claims

Quick and simple claims process, ensuring minimal disruption.

Covers Hearing Aid

Accessories

Includes Bluetooth devices, remote controls, and wireless accessories.

Affordable & Flexible Payment Plans

Choose between one-time payments or convenient monthly instalments.

Consultation Reimbursement & Re-Fitting Costs

Up to £150 annually following an insured loss.

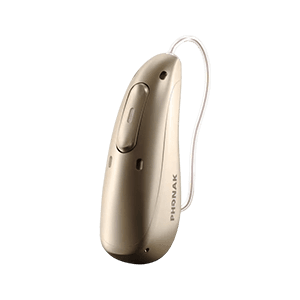

What Types of Hearing Aids Are Covered?

We provide coverage for a wide range of hearing aid types, including:

Behind the Ear (BTE) & BTE Mini

Receiver in the Ear (RITE)

In the Ear (ITE) & Completely in the Canal (CIC)

Body-Worn Hearing Aids

Bluetooth & Wireless-Connected Hearing Devices

Your policy provides coverage on a replacement as new basis, ensuring that if your hearing aids are lost or damaged, you receive a like-for-like replacement at full value.

Who Can Apply for New Hearing Aid Insurance?

Eligibility: Available to UK residents aged 18 and over.

Expert Support: In case of a claim, return to your audiologist for assistance and device replacement.

Flexible Payments: Choose from credit card, debit card, or monthly instalments.

What is Covered?

- Loss & Accidental Damage ensuring your hearing aids are replaced or repaired promptly.

- Unexplained Disappearance where your hearing aids go missing unexpectedly.

- Theft Protection for stolen hearing aids, ensuring a hassle-free replacement.

-

Worldwide Travel Cover for up to 60 days per trip while traveling

abroad. - Consultation & Re-Fitting Reimbursement of up to £150 per year.

What is Not Covered?

- Loss or damage while swimming or engaging in water sports.

- Theft not reported to the police within 24 hours.

- Routine servicing, maintenance, or battery replacements.

- Wear and tear, gradual deterioration, or manufacturer defects covered by a warranty.

- Loss or damage from nuclear risks, terrorism, or war-related incidents.

Frequently Asked Questions

Why do I need hearing aid insurance?

Hearing aids are significant investments and essential for daily life. They are also, small, portable, and at lot of risk, and it is expensive to repair or replace them. Getting a comprehensive hearing aid insurance is a valuable safeguard and with Hear4U+Assetsure Hearing Aid Insurance, you can have peace of mind knowing your hearing aids are fully protected.

How do I make claim if my hearing aids are lost, stolen or damaged?

Making a claim is quick and hassle-free:

- Report any loss or theft immediately (police report required for theft claims).

- Contact our claim department with details of incident.

- Provide necessary documents, such as proof of purchase and audiologist reports if needed.

- Receive approval and get your replacements or repair arranged swiftly.

- We prioritise minimal disruption to ensure you regain clear hearing without delay.

Can I insure multiple hearing aids under one policy?

Yes, if you use two hearing aids or have multiple hearing aids for different situations, they can all be insured under one policy. Simply provide details of each device when applying and we’ll tailor the coverage accordingly.

Does my hearing aid insurance cover accidental loss in public places?

Absolutely! Our all-risk policy covers hearing lost at home, in public places, or even while traveling. Whether your devices are misplaced at a café, on public transport or at workplace, you can file a claim and get a replacement hassle-free.

Do I need to provide proof of purchase for my hearing aid?

Yes, we require proof of purchase or a valuation certificate to ensure the correct insurance coverage is provided. This helps in processing claims efficiently and ensuring you receive the correct replacement value.

Can I cancel my hearing aid insurance policy if I no longer need it?

Yes! If you decide that you no longer need insurance, you can cancel the policy at any time. If you cancel within the first 30 days, you will receive a full refund provided no claims have been made. After this period, partial refunds may be available based on the terms of the policy.